When an employee is taken to a German payroll, then the employer is obliged to deduct the income taxes and contributions from the employee's salary and to pay these to the authorities. Also employer's payments apply.

If an employee is being put on the payroll of a German company, then usually also German income taxes and the following social security contributions do apply:

- health insurance (gesetzliche Krankenversicherung): it covers the costs of doctor’s appointments, medicines and Treatments;

- long-term care insurance (gesetzliche Pflegeversicherung): it offers basic provision for the event that you become dependent on long-term care as a result of illness;

- unemployment insurance (gesetzliche Arbeitslosenversicherung): it provides an income while you are looking for work, subject to certain conditions, and provides support in the form of advisory and placement Services;

- pension insurance (gesetzliche Rentenversicherung): it provides rehabilitation benefits and pays old-age pensions, reduced earning capacity pensions, or pensions to your surviving dependants in the event of your death.

- accident insurance (gesetzliche Unfallversicherung): it covers the costs of medical treatment and occupational reintegration after an accident at work or in the case of occupational diseases. It funds a wage replacement benefit while you are unable to work and a pension if your health is permanently damaged, as well as benefits for surviving dependants.

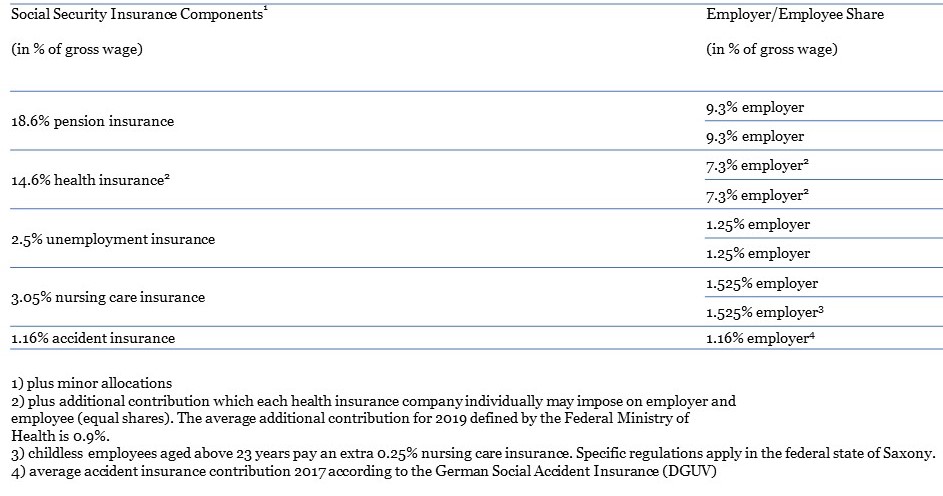

At these contributions, both the employee and the employer have to participate with ca. 50 %.

In more detail, the following ca. percentages of the gross salary apply as in the different Areas:

Payments are to be done on a monthly basis. The employee's income taxes have to be identified, deducted from the salary and paid by the employer to the Tax Authority (Bundesfinanzamt).

Please do not hesitate to contact us, if you need additional information or support with setting up a company in Germany.

Dr. Dwyer Legal Law Firm, Schwanthalerstr. 13, Aufgang IV, 80336 Munich

Tel: +49 (0)89 24 88 14 310, www.dwyer-legal.com

Note: Information provided in this Knowledge Database is for orientation only and not binding.